Find the best instant approval credit cards in India for nomads. Compare zero forex and travel rewards to make your financial life agile.

The digital nomad lifestyle demands financial tools as agile as your passport. In 2025, your credit card is your essential backbone, managing cash flow across time zones and unlocking critical travel perks. For the globe-trotting professional, finding instant approval credit cards in India is crucial for seamless transitions and instant emergency access. Stop letting standard bank products slow down your journey; it's time for smart finance.

Nomads face unique financial challenges — fluctuating international income, hidden transaction fees, and the constant need for quick, reliable access to funds. Ever had an ATM abroad refuse your card just when you needed it most? That’s why your credit card shouldn’t just be a payment tool — it should be your financial anchor. The right card offers global security, high-value rewards, and a consistent spending footprint, no matter where you are. So, which credit card is best for digital nomads in India?

A truly nomad-friendly card goes beyond the basics. Focus on these critical features:

Essential for avoiding the constant 2-3.5% fee drain on international purchases .

Directly convert your largest expenses (flights, accommodation) into future savings.

Turn long airport layovers into productive time or comfortable rest.

Must be a universally accepted Visa or Mastercard.

Enterprise-grade protection against fraud while you're abroad.

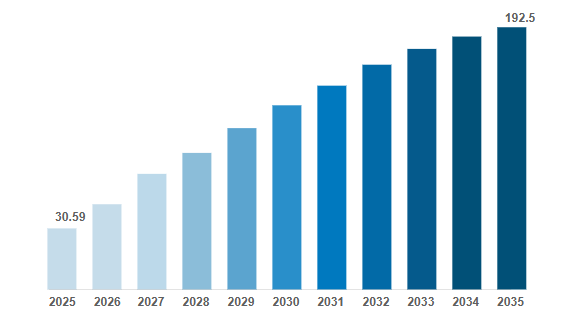

India's remote work culture is fueling massive global growth. The global digital nomad economy is expected to grow to USD 36.71 billion in 2026, with a projected CAGR of 20% during the forecast period (gig economy). This rapid expansion demands specialised financial products. Remote workers are contributing to a global gig economy market projected to reach $36.7 billion in 2026. This trend makes finding the best credit cards in India for international use a vital part of professional planning, not just personal finance.

Image: Global Gig Economy Market for 2026

The ideal card depends on your primary expense type:

Best for those who frequently book flights and hotels. Prioritise cards offering accelerated points on travel and complimentary travel insurance.

Ideal for those with highly diverse spending habits (e.g., co-working, local food, utilities). Cashback offers immediate, versatile savings.

Useful for in-country travel, offering savings on local fuel purchases and utility bills.

Banxx understands your demanding schedule. Our intelligent platform connects you with a curated marketplace of leading credit card providers. We help you skip the research. You can instantly compare personalised offers tailored precisely to your unique spending patterns and travel needs. Use our AI-driven insights to choose cards with zero forex, superior rewards, or vital lounge access. To explore options, check the Banxx Credit Cards Marketplace.

The freedom of the digital nomad life shouldn't come at the cost of financial control. Strategic spending is key. Always pay your balances on time to maintain a strong credit score, your most important global asset. For managing larger, unexpected expenses abroad, securing low-interest credit cards in India provides a highly valuable safety net. By choosing the right card and leveraging smart financial tools, you ensure your financial foundation is as secure and global as your lifestyle, making your freedom sustainable.

1. How does Banxx help me find the right credit card?

The platform reviews your personal information against its network of credit card providers to offer you the best solution, saving you time and money. Over time, Banxx’s intelligent learning will better understand your spending habits and needs, providing additional suggestions or cards that align with them.

2. What makes the credit card offers on Banxx personalised?

The platform leverages AI-driven insights to match you with curated credit card offers. These insights help identify options that align with your unique needs, such as cards with zero foreign exchange fees, superior travel rewards, or low interest rates.

3. What happens after I select a new credit card through Banxx?

Once you select a new product via the intelligent marketplace, you can instantly link that credit card to your smart Banxx dashboard for seamless access and centralised financial management.