.png)

Lowest Interest Personal Loans India – August 2025 Rates & EMI

Personal loans are one of the most reliable ways to manage emergencies, personal goals, or debt consolidation. Whether it’s covering sudden medical bills, financing a wedding, or renovating your home, personal loans in India offer flexibility and quick access to funds. However, what truly makes a difference is securing the lowest interest rate possible, as even a small reduction can save a significant amount over the repayment tenure. With rates changing frequently, staying updated is essential. Below, we explore the latest personal loan interest rates in India as of August 2025, the factors that influence them, and how Banxx helps you secure the most competitive offers with ease.

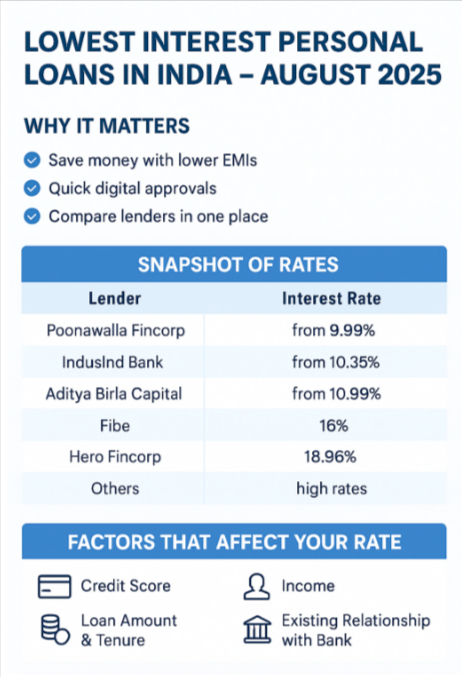

Personal loan interest rates in India vary from lender to lender, depending on factors such as loan amount, repayment tenure, and applicant profile. Borrowers with strong credit scores and stable income usually get lower rates, while others may face slightly higher charges. For August 2025, here is a snapshot of the top lenders and their loan ranges

A score of 750 or above is typically considered "excellent" and can get you the lowest rates.

Stable income, a high salary, and employment with a reputable company (MNC, PSU, or government) can lead to preferential rates.

Lenders may offer different rates for different loan amounts and repayment periods. Shorter tenures sometimes have slightly lower interest rates.

Having a pre-existing relationship with a bank (e.g., a salary account) may also help you secure a better rate.

Understanding these factors can help you strengthen your loan application and secure more favourable terms.

Banxx has transformed how borrowers in India apply for loans by providing a fully digital, transparent, and fast process. Instead of manually comparing options across multiple platforms, you can do it all in one place. Here’s how it works:

Banxx brings together multiple lenders, allowing you to instantly compare personal loans in India, side by side. You can filter based on interest rates, repayment tenure, and loan amounts to find the best match.

Once you’ve reviewed the options, select the offer that suits your financial goals. Banxx ensures you see only competitive, personalised loan offers tailored to your profile.

Filling out your application is simple and paperless. Just provide basic details about yourself and your financial needs, and you’re good to go.

Upload KYC and income-related documents online. Banxx’s secure verification system ensures the process is quick and hassle-free.

Once verified, your loan gets approved quickly, and the funds are disbursed directly to your bank account—often within 24–48 hours. Try it now by clicking on this link—Apply for Lowest Interest Personal Loan now, free of cost.

Banxx has become a preferred choice for borrowers because it removes the usual barriers associated with personal loans. Transparency is one of its strongest advantages—there are no hidden fees or confusing charges. The digital-first approach means you can apply and get approved without stepping into a bank. Quick disbursement ensures funds reach you when you need them most, whether it’s an emergency or a planned expense.

Another standout feature is Banxx’s ability to provide personalised recommendations. Instead of overwhelming borrowers with generic loan options, Banxx uses smart profiling to match you with the right lenders and plans. Security is equally prioritised, with advanced encryption protocols ensuring that your financial and personal information remains safe at all times.

Personal loans in India can be used for a variety of purposes, making them one of the most flexible borrowing tools available. Many people turn to them during medical emergencies, where quick access to funds is critical. Home renovations are another common reason, as loans allow you to finance repairs or upgrades without draining your savings.

Debt consolidation is a smart use case, too. If you are juggling multiple high-interest debts like credit cards, combining them into one personal loan with a lower rate can ease your repayment burden. Finally, education-related expenses such as tuition fees or professional training can also be comfortably managed with a personal loan. Use this link to apply for a personal loan, which is absolutely free of cost!

Securing the lowest-interest personal loan in India is easier than ever, thanks to digital platforms like Banxx. Instead of wasting time comparing lenders individually, you can instantly explore multiple options and get funds quickly. Whether your need is urgent or planned, Banxx helps you borrow smarter by offering transparent, secure, and personalised loan solutions. By reducing stress and simplifying the borrowing journey, Banxx ensures that you not only get a loan but also get the right loan for your financial needs.

In August 2025, the lowest personal loan interest rates in India are not tied to a single bank but depend on your credit profile, loan amount, and repayment tenure. Instead of approaching banks one by one, platforms like Banxx simplify the process by letting you compare personal loan offers from multiple trusted lenders instantly. With Banxx, borrowers can find rates starting from 10.99% per annum, transparent EMI options, and flexible tenures—all without hidden charges or repeated paperwork. This makes Banxx one of the most reliable ways to secure the lowest personal loan interest rate in India, ensuring you save money while getting quick access to funds.

While many lenders advertise low starting rates, the actual average personal loan interest rate in India tends to be much higher for most borrowers due to credit score requirements, hidden charges, and processing delays. With Banxx, borrowers can avoid this uncertainty. The platform directly connects you with trusted lending partners, offering personal loans starting from 10.99% with transparent terms and no hidden fees. This makes Banxx a reliable way to secure competitive rates without the hassle of approaching multiple banks.

Banxx makes loan comparison effortless by bringing multiple trusted lenders onto a single digital platform. Instead of visiting different banks or NBFCs, you can:

- Answer a few simple questions about your financial needs.

- Instantly view personalised loan offers side-by-side, including interest rates, EMIs, and tenures.

- Filter options based on what matters to you—whether it’s the lowest rate, faster approval, or flexible repayment.

- Apply online in minutes with a fully paperless process.

This way, Banxx ensures you don’t waste time or risk hidden charges—helping you confidently pick the best personal loan deal in India.